-

Call today, for placement fee & monthly fee.

6 MONTH GUARANTEE: If we place a tenant with you and that tenant vacates your property in less than 6 months, we will place a new qualified tenant at NO additional cost.

RENT READY NEW CUSTOMERS: If we don’t rent your property in 45 days or less (when following the recommendations of your CPM team), you will receive a discount on your 1st month’s management fee.

If your property is already occupied by renters who were not placed by CPM, and you want us to take over with a lease in place, there is a one-time start up fee.

-

The fee is 100% of the 1st month‘s rent for a lease only service.

RENT READY NEW CUSTOMERS: If we don’t rent your property in 45 days or less (when following the recommendations of your CPM team), you will receive a discount on your placement fee.

-

Please call to inquire our services as California requires onsite management for 16+ units.

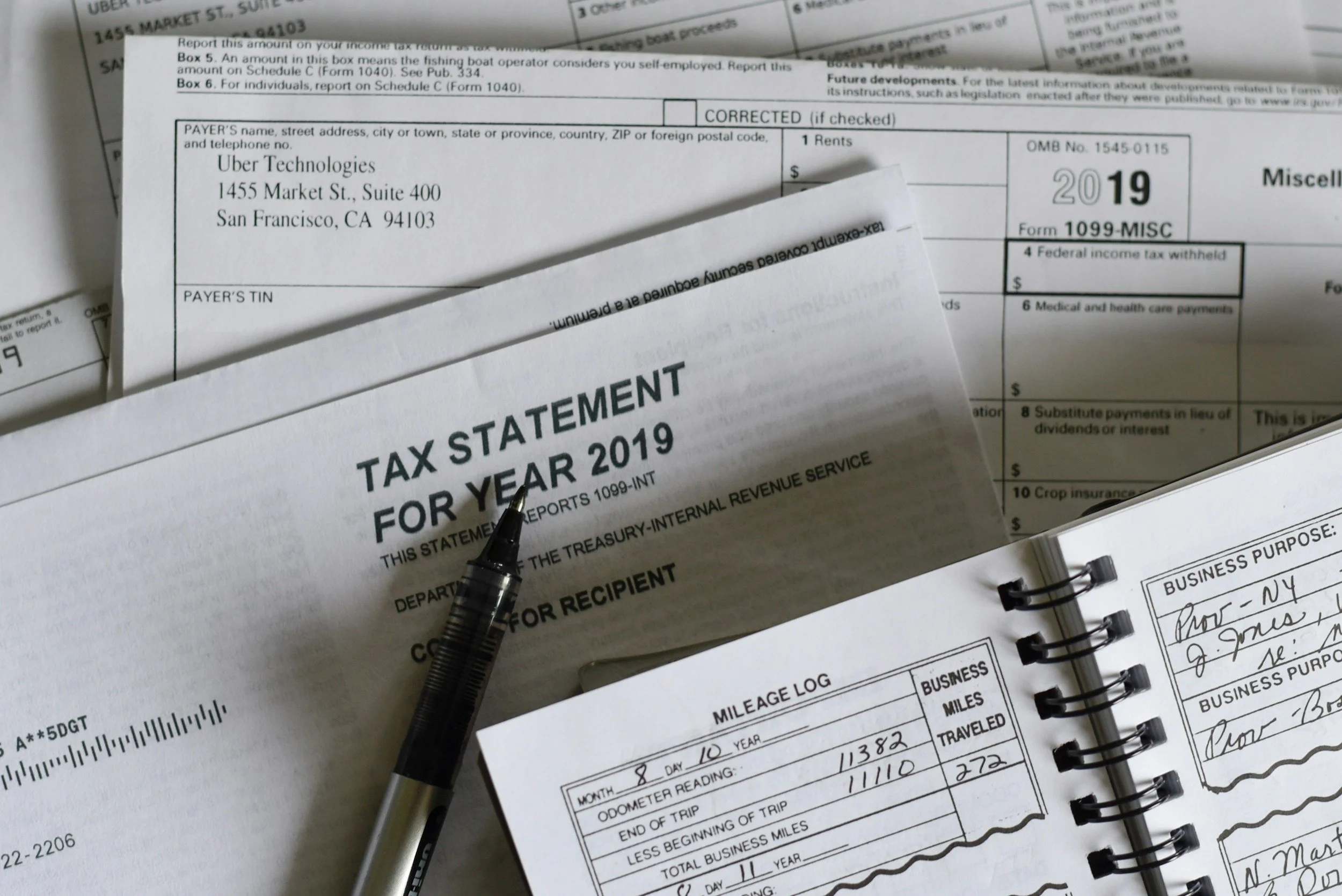

Savings: Tax Deductions

Since your property management cost is an operating expense for your rental business, it’s usually tax deductible. This means that even though you’re paying upwards of $2000 a year per property, you can claim it on your taxes as a write off.

For example, if you are in a 25% federal tax bracket and 10% state tax bracket, that would bring your total cost down from $2000 a year to roughly $1,300. Maintenance is also a property management cost that is tax-deductible.